Economic Update Q2 - 2024

- Schulman Group

- 28 juin 2024

- 5 min de lecture

Navigating Economic Challenges: Insights and Strategies for Today's Market

Welcome to our second economic update of the year. In this report, we delve into the intricacies of the current economic landscape, offering insights into key developments shaping global markets and investment strategies.

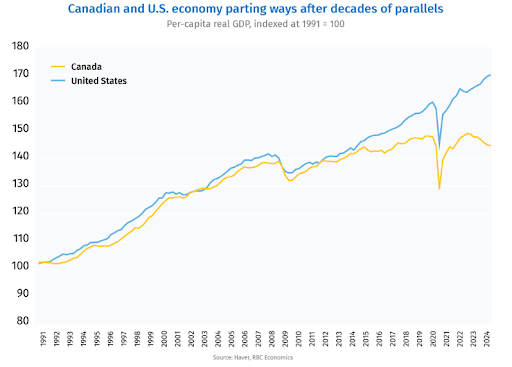

The past months have been marked by notable shifts and challenges across various fronts, from diverging economic performances between Canada and the U.S. to the continued dominance of tech stocks propelling market highs. Geopolitical tensions, particularly in trade relations between major players like the U.S. and China, further underscore the complexities at play.

As your trusted advisors, we aim to provide you with a comprehensive analysis of these developments along with strategic recommendations to navigate the evolving economic environment effectively. We are grateful for your continued confidence and are excited about the opportunity to assist you in achieving your financial goals.

Balancing Act: Navigating Canada’s Economic Divergence and Interest Rate Strategy

The headline consumer price index in the U.S. grew at an annualized 4.3% from December to April, compared to just 1.3% in Canada. Canada’s economic underperformance relative to the U.S. since 2023 is unusual given their close cross-border economic ties. By Q1 2024, the gap in gross domestic product growth reached a record high. Considering this strong divergence, the Bank of Canada must balance lowering interest rates without eroding the loonie’s purchasing power relative to the Greenback. Canada imports about 70% of its goods from the U.S., and the two countries share extensive trade ties, with $1.3 trillion worth of goods and services traded in 2023. A weaker Canadian dollar, resulting from a widening rate gap, would raise import prices. However, domestic factors like transportation costs and pricing practices also influence consumer prices. Although Canada trades significantly with the U.S., 65% of its final consumer goods imports come from other regions, and the Canadian dollar has not weakened as much against other currencies like the Chinese Renminbi. With 60% of all outstanding mortgages maturing within the next three years at Canadian chartered banks, sustained high interest rates could cause payment shocks, leading to significant increases in individual debt and potential loan defaults. At the beginning of June, the Bank of Canada cut its rate by 25-basis point to 4.75% and we anticipate another 25-basis point cut before the end of the year. Meanwhile, we will possibly only have one interest rate cut in the U.S. when inflation stabilizes below 3%, not necessarily reaching the standard 2% target.

Market Dynamics: S&P 500 Reaches New Highs Amid Economic Fluctuations

Over the past few weeks, the S&P 500 has consistently reached new highs, primarily driven by tech stocks, especially Nvidia, which surpassed a $3 trillion market cap. This achievement places Nvidia alongside Apple and Microsoft as the only companies in the world with a market cap above $3 trillion. As of May 31st, the “Magnificent 7” tech stocks had returned 21%, compared to 5% for the S&P 500 excluding them. Despite these market highs, the forward P/E ratio on May 31st was 20.47x, higher than the 30-year average of 16.66x but lower than the previous peak of 22x in 2021, indicating the market is neither particularly cheap nor expensive. Markets remain sensitive to Federal Reserve policy signals and interest rate directions, nevertheless, considering the market performance over the last 18 months, there is a legitimate question about the immediate need to lower interest rates. Recent private payroll data from ADP showed hiring slowed to 152,000 jobs last month, significantly below the expected 175,000, signalling labour market weakness that could prompt the Federal Reserve to cut benchmark interest rates. The U.S. 10-year Treasury yields rebounded from a two-month low but remained lower after data indicated growth in the U.S. services sector in May. With anticipated interest rate cuts in the coming months or years, there could be a resurgence in value and dividend stocks, such as telecoms and utilities. Growth, small-cap, and mid-cap stocks are also likely to appreciate in a lower-rate environment as their financing costs decreases.

Geopolitical Tensions and Trade: Navigating New Challenges in Global Commerce

Geopolitical tensions, exemplified by recent actions such as U.S. President Joe Biden's unveiling of steep tariff increases on Chinese imports, including critical components like electric vehicle batteries and computer chips, are reshaping global trade dynamics. The United States' persistent trade gap with China, totaling $279 billion in 2023, reflects longstanding trade imbalances exacerbated by retaliatory threats from China, such as potential tariffs of up to 25%. These tensions have notably impacted bilateral trade between the U.S. and China, growing at a slower pace compared to their trade with other nations since 2018. Despite forecasts of a sharp rebound in global trade by international bodies like the OECD, IMF, and WTO, regional conflicts and geopolitical tensions, including China's military drills near Taiwan, threaten to disrupt trade patterns further. For instance, disruptions in the Suez Canal due to Middle East conflicts have already affected sectors like automotive products and retail due to delays and increased freight costs. Additionally, trade flows between hypothetically aligned blocs have slowed since the onset of the Ukraine war, indicating the far-reaching effects of geopolitical instability on global commerce. Such tensions could lead to price spikes in food and energy, impacting industries worldwide. Furthermore, the possibility of a semiconductor shortage resulting from potential conflicts poses a significant risk to industries reliant on these crucial components, such as electronics and metals markets. Overall, we cannot discount the importance of these ever-evolving events on inflation and profitability for companies operating in these markets.

Conclusion

The bond market has struggled over the past two years as central banks raised rates from 0% to 5%. However, with anticipated rate cuts, this asset class is likely to improve in the coming months. Meanwhile, we continue to find opportunities in equities and have cash set aside to reinvest in undervalued stocks or rebalance models if there is a market pullback. The upcoming U.S. presidential election, featuring a rematch between President Joe Biden and former President Donald Trump, both of whom have secured their party nominations, could introduce additional volatility. Trump is facing legal challenges, including 34 counts of falsification of business records related to alleged hush money payments during the 2016 campaign. We are monitoring these political events closely, as Trump's potential election could impact Canadian exports next year, similar to his previous term's policies. In the event of market volatility due to the election, we plan to utilize our cash reserves to take advantage of market opportunities and ensure portfolio stability.

With over 35 years of combined experience in wealth management, navigating various market cycles, our team excels in making strategic investment decisions that optimize value and provide robust safeguards against potential downturns. As always, we remain committed to providing unwavering support and guidance, ensuring that any questions or concerns are promptly addressed to uphold our commitment to your financial well-being and thank you for entrusting us with your financial goals.

National Bank Financial - Wealth Management (NBFWM) is a division of National Bank Financial Inc. (NBF), as well as a trademark owned by National Bank of Canada (NBC) that is used under license by NBF. NBF is a member of the Canadian Investment Regulatory Organization (CIRO) and the Canadian Investor Protection Fund (CIPF), and is a wholly-owned subsidiary of NBC, a public company listed on the Toronto Stock Exchange (TSX: NA).

The particulars contained herein were obtained from sources we believe to be reliable, but are not guaranteed by us and may be incomplete. The opinions expressed are based upon our analysis and interpretation of these particulars and are not to be construed as a solicitation or offer to buy or sell the securities mentioned herein. The opinions expressed do not necessarily reflect those of NBF.

I have prepared this report to the best of my judgment and professional experience to give you my thoughts on various financial aspects and considerations. The opinions expressed represent solely my informed opinions and may not reflect the views of NBF.

The securities or sectors mentioned herein are not suitable for all types of investors. Please consult your Wealth Advisor to verify whether the securities or sectors suit your investor's profile as well as to obtain complete information, including the main risk factors, regarding those securities or sectors.

Commentaires